Diamonds have long been symbols of luxury, beauty, and timeless elegance. Besides their undeniable aesthetic value, many buyers consider diamond jewellery an attractive investment option. But is diamond jewellery truly a wise financial decision? Can diamonds genuinely hold or even increase their value over time?

This comprehensive guide examines diamond jewellery as an investment, exploring its potential benefits, key considerations, and practical advice for making informed investment choices with DiamondTalk.

Understanding Diamond Jewellery as an Investment

When considering jewellery investments, diamonds often come to mind due to their enduring appeal and perceived value. To assess diamonds as investments clearly, it’s important to understand what defines a good investment and how diamond jewellery aligns with these characteristics.

What Makes Diamond Jewellery an Attractive Investment?

Several key factors contribute to diamond jewellery’s appeal as an investment:

- Intrinsic Value and Rarity: Natural diamonds are finite, naturally scarce commodities, enhancing their potential for sustained value.

- Timeless Appeal: Diamonds hold universal, cross-cultural appeal, consistently desired in global jewellery markets.

- Portability and Stability: Diamonds offer high value within a small, easily transportable asset. They are also durable, maintaining quality and brilliance indefinitely with minimal care.

Do Diamonds Appreciate or Retain Value?

When evaluating diamonds for investment, the central question is whether diamonds appreciate, retain, or lose value over time. Here’s what investors should understand clearly:

Value Retention

Generally, high-quality diamond jewellery maintains its value effectively, particularly if bought at fair market prices from reputable sellers. Diamond value retention typically outpaces other luxury commodities due to their rarity and demand stability.

Appreciation Potential

Historically, diamonds experience stable or slow appreciation rather than dramatic short-term price fluctuations. Certain diamonds, such as high-quality stones with excellent clarity, desirable cuts, significant carat weights, or rare colours, hold stronger appreciation potential over the long term.

Factors Influencing Diamond Appreciation

Diamond appreciation is affected by several market and quality-related factors:

- Quality of the Diamond: High-quality diamonds (VVS clarity, excellent cuts, and higher carats) typically appreciate better.

- Rarity and Demand: Diamonds with rare attributes (fancy colours or exceptional clarity) usually appreciate more significantly.

- Economic Conditions: Economic stability and growing wealth in key global markets tend to drive sustained or increasing diamond jewellery demand.

Pros and Cons of Investing in Diamond Jewellery

Diamond jewellery offers both advantages and disadvantages as an investment option:

Pros of Diamond Jewellery Investment

- Long-term Value: Diamonds maintain stable value, making them suitable for long-term, stable investment portfolios.

- Portability and Durability: Diamonds are easily transportable, tangible assets unaffected by market digitalisation, cyber threats, or electronic market volatility.

- Aesthetic and Emotional Value: Diamond jewellery combines financial investment with personal enjoyment and emotional significance, adding intangible value.

Cons of Diamond Jewellery Investment

- Liquidity Challenges: Selling diamond jewellery quickly at market value can be more challenging than other investments like gold or securities, due to market factors or individual diamond attributes.

- Market Price Fluctuations: Diamonds may not always appreciate significantly in the short term, particularly lower-quality or commonly available diamonds.

Tips for Investing in Diamond Jewellery Wisely

Making diamond jewellery a smart investment choice requires informed selection and practical strategies:

Choose High-Quality Diamonds

Invest in diamond jewellery featuring high-quality stones, prioritising excellent cuts, higher clarity (VVS or above), desirable colour grades, and reputable certifications such as GIA (Gemological Institute of America). These diamonds typically hold or appreciate in value effectively.

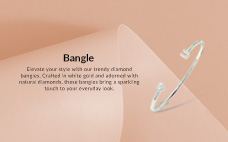

Opt for Classic Designs

Select timeless jewellery designs that maintain broad appeal and stable demand. Simple, elegant pieces, such as solitaire rings, stud earrings, and classic pendants, offer stronger resale potential than trendy, contemporary designs.

Buy from Reputable Jewellers

Choose trusted jewellers like DiamondTalk, known for quality craftsmanship, transparent pricing, certified diamonds, and expert guidance. Buying jewellery with clear documentation and trusted certification ensures lasting value and easier resale.

Consider Rare or Coloured Diamonds

Coloured diamonds, particularly rare hues such as pink, blue, or vivid yellow, often hold strong investment potential due to their extreme rarity and increasing global demand among collectors and luxury buyers.

Maintain Jewellery Quality

Ensure regular maintenance and professional inspections. Jewellery kept in pristine condition—secure settings, clean diamonds, polished metal—retains maximum resale value and aesthetic appeal.

Diamond Jewellery vs Other Investments: A Comparison

To evaluate diamond jewellery investment clearly, compare it against other investment forms:

Diamond Jewellery vs Gold

Gold generally offers greater liquidity, easily sold at market prices. Diamonds provide stable value, portability, and combined aesthetic and financial benefits. Diamonds generally appreciate more slowly but consistently compared to gold’s shorter-term fluctuations.

Diamond Jewellery vs Real Estate

Real estate offers potentially high appreciation but involves higher entry costs, less portability, and market volatility risks. Diamonds provide smaller, portable assets offering stability and steady appreciation potential.

Diamond Jewellery vs Stocks or Bonds

Stocks or bonds offer strong liquidity and potential short-term gains but face greater volatility. Diamond jewellery offers tangible, stable, long-term value and emotional significance but generally less liquidity.

Making Diamond Jewellery Investment with DiamondTalk

At DiamondTalk, we understand the significance of diamond investments—both financial and emotional. Our curated collections offer thoughtfully designed jewellery pieces combining timeless beauty, expert craftsmanship, and exceptional diamond quality.

Expert Guidance and Transparent Certification

Every DiamondTalk diamond jewellery piece features reputable certifications clearly outlining diamond attributes, ensuring transparent valuation, resale potential, and trusted quality.

Exceptional Craftsmanship and Timeless Designs

DiamondTalk prioritises timeless designs and durable craftsmanship, offering jewellery suited to long-term value retention and appreciation.

Comprehensive Aftercare and Maintenance

DiamondTalk provides professional jewellery maintenance, regular inspections, and comprehensive guidance ensuring your investment retains value and condition beautifully over time.

Conclusion: Are Diamonds a Good Investment?

Diamond jewellery can indeed offer excellent investment potential, combining aesthetic appeal, lasting value, emotional significance, and stable market performance. When selected wisely—prioritising high-quality diamonds, timeless designs, and reputable sourcing—diamond jewellery can enhance and diversify your investment portfolio, delivering tangible and intangible rewards.

Explore DiamondTalk’s exclusive natural diamond jewellery collections, expertly curated to provide lasting beauty, sustained value, and emotional significance for generations. Make informed, rewarding jewellery investments that beautifully celebrate life’s milestones, accomplishments, and cherished moments.

FAQs: Diamond Jewellery as an Investment

Do diamonds hold their value well?

Yes, high-quality diamonds generally retain their value effectively over the long term, particularly if bought from reputable jewellers at fair market prices.

Can diamonds appreciate in value significantly?

While diamonds typically experience stable, gradual appreciation, rare or high-quality diamonds may appreciate significantly, driven by growing demand and global market trends.

What makes certain diamonds better investments?

Diamonds with excellent clarity (VVS), desirable colours, quality cuts, higher carats, and reputable certifications (such as GIA) hold stronger investment potential.

Is diamond jewellery easily resalable?

Quality, classic-design diamond jewellery typically offers good resale potential. However, liquidity might be slower compared to gold or securities, requiring careful market consideration.

Are diamonds a better investment than gold?

Diamonds offer stable, long-term appreciation, portability, and aesthetic enjoyment, while gold offers greater short-term liquidity. Both are valuable but serve different investment preferences.